Table of contents

Let’s be real—jumping into trading without a plan is like driving blindfolded and hoping you hit a shortcut. How to Set Up Effective Trading Goals isn’t just a fancy headline—it’s your blueprint for turning random trades into real results. This guide strips the fluff and shows you how to set goals that stick, protect your cash, and keep you sane when the market gets wild.

As Warren Buffett said, “Risk comes from not knowing what you’re doing.” And let’s face it, too many new traders get burned because they chase hype, not strategy. Trading goals anchor your decisions so you’re not just reacting—you’re executing.

In the next sections, we’ll help you lock in on what you really want from trading, how much skin you should put in the game, and what rules will keep you on track. Let’s get to it.

Trading Goals and Timeframes

If your trading goals don’t match your timeline, you're setting yourself up to miss the mark. Let's help you lock in the right timeframe for your style and lifestyle.

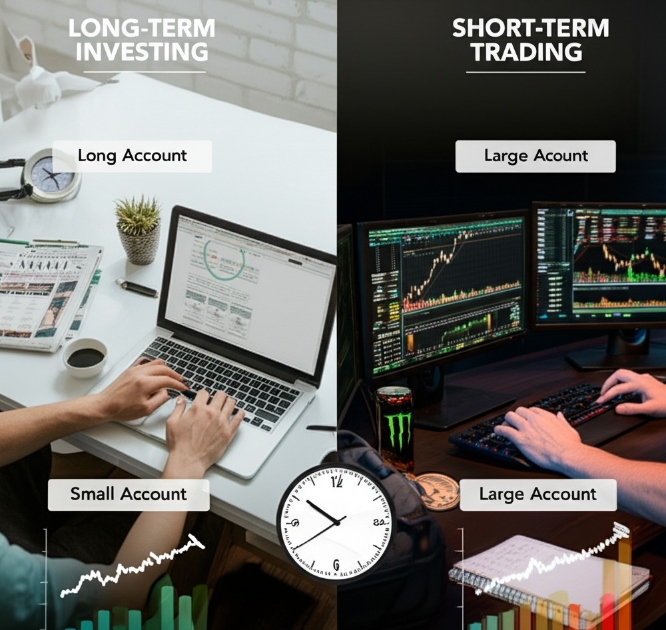

Short-term vs long-term trading goals

Not all financial goals play by the same rules.

Short-term trading (e.g., day or swing trading) is fast-paced and ideal for those seeking income generation or speculative trading.

Long-term investing aims at wealth accumulation with less frequent trades and more room to breathe.

Your choice depends on risk tolerance, financial objectives, and how much screen time you’re willing to commit.

"Know your timeline, or the market will choose one for you."

Matching timeframes with trading lifestyle

Your trading timeframe should flow with your personal lifestyle and daily routine. Here's a quick comparison to help you figure out what fits:

| Lifestyle Factor | Best-Fit Timeframe | Strategy Type |

|---|---|---|

| Limited free time | Weekly/Swing Trading | Passive Investing |

| Flexible schedule | Intraday/Swing | Mixed Approach |

| Full-time trader | Day Trading/Scalping | Active Trading |

| High stress levels | Weekly/Monthly | Low-Frequency Trades |

Choosing goals by account size

Your account capital sets the tone for what’s realistic.

Small accounts benefit from conservative position sizing and smaller profit targets.

Large accounts offer room for flexibility, leverage, and deeper capital allocation.

Tip: Don’t overextend. Let your initial investment grow through compounding returns, not risky overreach.

How timeframes affect your strategy

Your chosen trading timeframe shapes everything—from tools to tactics.

Short-term strategies lean on technical indicators, fast entry/exit points, and tight stop losses.

Long-term setups favor fundamental analysis, wider trade frequency, and macro trends.

A mismatch between your strategy and timeframe is one of the top reasons traders fail. Test thoroughly with backtesting to make sure it holds up.

How Much Capital Do You Need to Start

Before jumping into trades, you need to figure out how much skin you should actually put in the game—without torching your savings.

Starting small with smart expectations

Think of your trading journey like building a startup—you don’t launch big right out of the gate. You start with a strategic entry, test with controlled experiments, and focus on gradual expansion.

This is your pilot phase, where every dollar teaches you something. You’re not trying to hit home runs here—you’re laying a foundational plan that’s scalable as you grow.

“The market is a classroom—tuition varies, but learning is priceless.” — Linda Raschke, veteran trader

Margin, leverage, and capital risk

Understanding capital exposure is critical in leveraged environments. You can win big, sure—but market volatility doesn’t discriminate. Here’s how the numbers look when you apply different levels of leverage:

| Leverage Ratio | Required Margin (on $10,000 trade) | Liquidation Risk (High Volatility Days) |

|---|---|---|

| 1:1 | $10,000 | Low |

| 5:1 | $2,000 | Medium |

| 10:1 | $1,000 | High |

| 20:1 | $500 | Very High |

Key terms:

- Margin calls can occur fast with tighter stopouts.

- Debt-to-equity ratios matter more as your position size grows.

- Stick to capital preservation strategies when unsure.

Emergency funds vs trading capital

Mixing your emergency savings with trading money is a recipe for disaster.

Separate your accounts: Your financial security should not hinge on your latest trade.

Only use surplus: Put aside true speculative capital—cash you can afford to lose.

Plan your liquidity: Reserve short-term funds for real-life needs, not market noise.

Good financial planning means your safety net stays intact even if your trades go south.

Markets Assets and Strategy Fit

You can’t master trading if you’re playing in the wrong arena.

Forex vs stocks vs crypto

Each market plays by its own rules:

Forex is 24/5, driven by macro news and currency pairs like EUR/USD.

Stocks offer regulated access to equities with deep company data.

Cryptocurrency moves fast, with Bitcoin and Ethereum riding blockchain sentiment.

Choose based on your schedule, info access, and appetite for volatility.

Volatility and your risk comfort zone

Volatility can be a thrill or a trap. If price swings make your stomach flip, you're likely trading outside your risk tolerance. Use indicators like the VIX index or ATR to gauge volatility and match it with your investment goals.

Pro tip: A tight stop-loss in a volatile market is like bringing a water pistol to a wildfire—know when to stand back.

Finding assets that match your edge

Find your lane before you try to race. If you're great at technical analysis, liquid assets like Forex or high-volume stocks give your edge room to shine. If you’re more of a fundamental analysis type, long-term positions in equities or niche markets may be your jam.

Look for market inefficiencies

Backtest your strategy on similar assets

Avoid markets where your strengths don’t matter

Liquidity and execution timing

Liquidity keeps your trades clean—no one wants slippage eating profits. Check the bid-ask spread and trading volume to see how easily you can enter and exit. Timing matters too. Trading during high market depth hours reduces price impact, especially when using market orders.

| Asset Type | Avg. Spread | Typical Liquidity Window |

|---|---|---|

| Forex (EUR/USD) | 0.8 pips | London/NY overlap |

| Stocks (AAPL) | $0.02–$0.05 | Market open hours |

| Crypto (BTC) | Varies | 24/7 – High around UTC 00 |

Picking a market niche to master

Choose a market segment that resonates with you (e.g. small-cap stocks or emerging markets)

Study it obsessively—understand the industry focus, seasonal patterns, and trading volume

Specialization builds your competitive advantage—you’ll start seeing patterns others miss

"The best traders don’t follow the market—they own a piece of it." – Linda Raschke

What Is Your Risk-Reward Target

Every trade is a bet—but smart traders don’t just bet, they calculate. Let’s dive into how risk and reward guide your every move in the market.

Understanding risk-reward trade-offs

If you're chasing reward without knowing the risk, you’re playing financial roulette. Great trading is all about balance—between fear, greed, and strategy.

| Strategy Type | Risk-Reward Ratio | Volatility Level |

|---|---|---|

| Day Trading | 1:1 to 2:1 | High |

| Swing Trading | 2:1 to 3:1 | Medium |

| Long-Term Investing | 3:1 to 5:1 | Low |

Your risk tolerance dictates which ratio feels "right."

Higher reward potential often equals higher volatility—know what you’re signing up for.

A well-balanced investment strategy respects both upside and downside.

"Risk comes not from volatility but from not understanding what you’re doing," says Peter Bernstein, famed economic strategist.

Setting profit targets that protect you

Locking in profits isn’t about being greedy—it’s about being smart. You need an exit strategy as airtight as your entry plan.

Define your investment goals. Are you growing capital or preserving it?

Use take-profit levels based on technicals, not vibes.

Set stop-loss orders to cap downside—your safety net.

This combo of profit maximization and capital preservation keeps you in the game long enough to win it.

Entry and Exit Rule Framework

Strong entries and exits are the heartbeats of solid trading. Nail this, and you’ll stop second-guessing every click. Here’s how to trade with clarity, not chaos.

Entry signals that fit your style

Trying to trade without defined entry criteria is like jumping into traffic blind. Use tools that fit your rhythm—moving averages, volume indicators, or trend lines. If you love structure, support/resistance zones work wonders. Prefer momentum? Try breakout signals with confirmation from candlestick patterns. Keep it tailored to your own strategy—not someone else’s.

Timing entries in different markets

Knowing when to enter can be more powerful than where. Here’s how market dynamics shift based on timing:

| Market Type | Optimal Entry Times | Key Considerations |

|---|---|---|

| Forex | London-NY overlap | Highest liquidity & volatility |

| U.S. Stocks | First & last trading hour | Use pre-market data for context |

| Crypto | Weekends & late nights | Avoid during thin liquidity |

Planning exits before you enter

Here’s where most new traders mess up—they enter with a plan to win, but none to leave. Your exit strategy should include:

Target price or breakeven point

Defined stop-loss levels (set before entry)

Backup exit rules like trailing stops

Partial profit-taking levels

You protect your capital by knowing exactly when to get out.

Stop-loss placement best practices

Volatility-based stops using ATR

Percentage-based stops (e.g., 2% per trade)

Anchoring stops to market structure like support/resistance

Trailing stops for trend trades

Avoid placing stops too tight—they’ll get hit by market noise. Too wide? You’re giving away profits.

Scaling in and out of trades

All-in, all-out is for poker—not trading. Use scaling tactics to smooth entries and exits.

Scaling in: enter in parts as a trend confirms

Scaling out: take profits gradually to secure gains

Use dollar-cost averaging to stay consistent in volatile markets

It’s a flexible way to manage risk and emotions simultaneously.

Tools to automate entries/exits

You’re not a machine, so let the machines help. Platforms like MetaTrader, NinjaTrader, and TradingView support algorithmic trading with:

Expert Advisors (EAs) or bots

Custom API integration for pros

Backtesting software to test rules before going live

Automation reduces impulsive decisions and keeps your plan on autopilot when needed.

Risk Control and Position Sizing

If you don't control risk, the market will do it for you.

Fixed fractional position sizing

This method is like putting on a seatbelt before hitting the gas. With fixed fractional position sizing, you risk a set percentage of your account (say, 1–2%) on each trade. This keeps your exposure steady, protects your capital on losing streaks, and lets winners compound over time.

Aligns with capital allocation and equity curve growth

Helps traders avoid emotional overleveraging

Closely related to Kelly criterion for risk efficiency

Scales with your account—bigger capital, bigger trades

A well-calibrated fractional model forms the spine of any risk management-driven trading strategy.

Daily risk limits and max drawdowns

Risk isn't just about the size of one trade—it’s about how much you’re putting on the line over the day or week. Setting clear daily risk limits and tracking your maximum drawdown helps enforce discipline and avoid blowups.

Cap your daily loss—e.g., 3% of total capital

Stop trading if the limit’s hit—emotion clouds judgment

Track rolling performance metrics weekly

“Preserve capital. Live to fight another day.” — Paul Tudor Jones

Keep an eye on your risk exposure and use stop-loss levels that match your trading timeframe.

Adjusting size based on volatility

Let’s say the market's jumpy—prices flying around like popcorn. That’s when volatility adjustment becomes your best friend. You can use indicators like ATR (Average True Range) or standard deviation to size your positions dynamically.

High volatility? Shrink trade size to avoid huge losses.

Low volatility? Size up modestly to stay efficient.

Protects your account when price swings get wild.

| Indicator Used | Volatility Level | Suggested Trade Size (%) |

|---|---|---|

| ATR (14) | High (>2.0) | 0.5% – 1.0% |

| ATR (14) | Medium (1–2) | 1.0% – 1.5% |

| ATR (14) | Low (<1.0) | 1.5% – 2.0% |

This adaptive strategy keeps you in sync with market conditions—kind of like wearing shorts in summer and bundling up in winter.

How Do You Measure Trading Progress

“Trading without tracking is like sailing without a compass,” says Carol Fleming, a performance coach who has worked with hundreds of retail traders across the U.S.

Real progress in trading does not come from intuition alone. It is driven by trading metrics—hard numbers that reflect what is working and what is draining your account. Metrics like profit and loss, drawdown, win rate, and expectancy tell a deeper story than a single green trade ever could.

Performance indicators every serious trader should log:

Risk-reward ratio: Are your wins worth the risk you take?

Win rate: How often are you right, and does it pay?

Drawdown: How deep do your losses go before recovery?

Expectancy: What is the average result per trade over time?

A consistent trading journal is your personal scoreboard. It shows patterns, highlights mistakes, and keeps your emotions in check. Pair that with backtesting results to see if your strategies survive more than a lucky week.

Performance reviews, ideally weekly or monthly, act as mental tune-ups. As Kathy Lien, managing director of FX Strategy at BK Asset Management, shared in an interview, “Without regular reviews, traders tend to repeat the same emotional errors—until it costs them everything.”

Smart traders measure, adjust, and grow. Every tracked number is a truth you can act on.

Discipline Review and Improvement

“I have blown more accounts from lack of discipline than bad trades,” confessed Marcus Tan, a seasoned day trader featured in Barron’s. His honesty echoes across countless trading communities. Discipline is not a bonus trait—it is the lifeline of consistent performance.

In trading, maintaining habits that align with your rules is a full-time job. Daily self-assessment builds this discipline muscle. Reviewing your trades with brutal honesty—what you followed, what you ignored—forms the backbone of improvement.

Adherence to your trade plan

Reaction to losses and gains

Emotional stability during volatility

Journaling consistency

Top traders often set weekly review blocks, using metrics like win rate, risk-to-reward ratios, and adherence scores. “Without feedback, you are trading blind,” says Linda Raschke, a market veteran.

Real improvement starts when feedback becomes a habit. Traders who treat performance review like a sport practice—every day, no excuses—tend to outperform peers driven only by emotion.

Consistency is not perfection. It is showing up, adjusting, and respecting your own rules. That is what builds trust in your strategy—and yourself.

Conclusion

Let’s be honest—trading without goals is like playing darts in the dark. You might hit something, but odds are it won’t be the bullseye. Laying down clear trading goals gives your strategy direction, purpose, and sanity when the charts get crazy.

“Discipline equals freedom,” as Jocko Willink says—and in trading, that discipline starts with a plan you actually follow.

Now it’s your move. Keep it simple, stay consistent, and tweak as you grow. That’s how smart traders win long term.

A solid beginner trading goal might be something like: "Maintain a 2:1 reward-to-risk ratio and aim for consistent performance over flashy profits." The idea is to survive and learn—not hit home runs. Set goals around consistency, discipline, and capital preservation before chasing big returns.

Simple formula:

(Potential Profit) ÷ (Potential Loss) = Risk-to-Reward Ratio

For example, if you're risking $100 to make $300, your ratio is 3:1. Most traders aim for 2:1 or higher to stay profitable over time.

Position sizing is how much of your capital you put into a single trade. It’s crucial for managing risk, especially during losing streaks. You can calculate position size using:

Used right, it keeps you in the game when trades go south.

Account size

Risk per trade (usually 1–2%)

Stop-loss distance

Asset volatility

There’s no magic number, but here’s a rough guide:

Start small, scale slowly, and protect your bankroll like it’s your lifeline.

$100–$500: Good for learning with paper trades or very small positions.

$1,000–$2,500: Enough to practice strategies, but limited flexibility.

$5,000–$10,000+: More room to manage risk, scale up, and handle losses.

Part-time traders often do best with 4-hour or daily charts. These timeframes:

Great for traders with day jobs or family obligations.

Require less screen time

Allow for thoughtful analysis

Reduce stress and emotional overtrading

Because memory lies. A trade journal gives you a black-and-white record of:

Over time, this builds self-awareness, reveals patterns, and exposes costly habits. It’s your trading mirror—honest, detailed, and unforgiving in the best way.

What you did

Why you did it

What happened

How you felt

Absolutely. Many traders lose not because of bad strategies but because of fear, greed, or FOMO. Building emotional control helps you:

Discipline isn't just part of the system—it is the system.

Stick to your plan

Avoid revenge trading

Take losses without panic

Let winners run without second-guessing