Table of Contents

What is the best Forex cashback program? These cashback deals are like getting rewarded for every lap you complete—trading as usual, but pocketing a bit back each time. To understand how these programs lower costs, see how work in practice on our platform.

Think of it like loyalty points for your trades. You’re already spending on spreads or commissions, so why not get a kickback? As Warren Buffett once said, “Do not save what is left after spending, but spend what is left after saving.” Cashback is one way to make that happen in Forex—use a to estimate how much you could get back per lot.

With rebate rates, payout speed, and trust on the line, picking the right provider isn’t just about deals—it’s about who’s really got your back. This guide breaks it all down so you can trade smarter, not harder. If you’re new to the space and want a quick primer, our hub covers the basics before you compare offers.

What Is the Best Forex Cashback Program?

"When you trade $50 million a month, even a 0.2 pip rebate matters," said Michael Trent, a professional trader with over a decade of experience navigating ECN accounts. His words echo what many savvy Forex traders know—selecting the best cashback program is not about luck. It is about detail. For a quick overview of how rebates integrate with live trading conditions (without changing your broker’s spreads/commissions), see the PAYBACKFX explanation of keeping trading terms the same and returning most IB commissions to traders (, ).

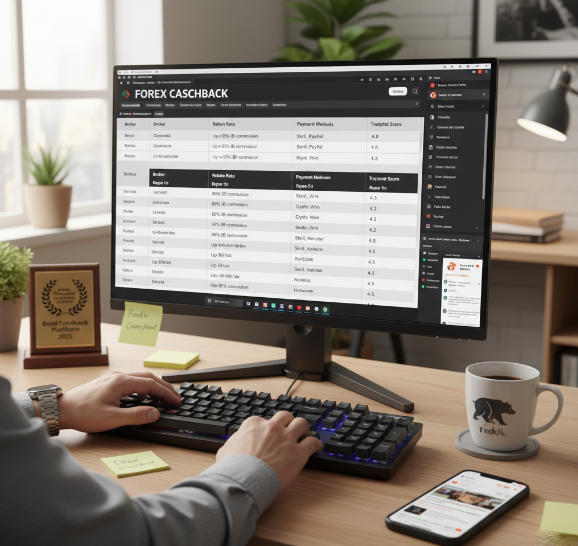

The standout programs today are evaluated through the lens of practical trader experience and expert endorsement. Programs like , , and are often cited for their high rebate rates, sometimes returning a large share of IB commissions (for example, FxCash advertises up to 95% of spread on select brokers, and Premium Rebate highlights up to 90% IB commission returned). This is where transparency makes a mark. Trusted platforms display rate structures clearly—no vague tables or locked tiers. You can compare supported brokers and rates directly on each provider’s broker list pages (e.g., and ).

Experts from Myfxbook’s rebate programs reviews emphasize essential criteria:

Payment methods that include Skrill, PayPal, and crypto (see provider pages such as FxCash’s “How rebates work” and PaybackFX broker pages that outline payout methods).

Minimum payout thresholds under $10 (varies by service; check each provider’s T&Cs and withdrawal pages).

Withdrawal speed under 24 hours (FxCash states withdrawals can be processed within 24 hours).

Regulated broker support across multiple jurisdictions (example: IC Markets outlines regulation and tight spreads; brokers are listed within providers’ directories).

Traders also weigh in on real-world usability. Broker compatibility ranks high, with platforms supporting broad broker catalogs (e.g., ) and third-party directories. The quality of customer support often becomes a dealbreaker— specifically advertises 24/7 live chat support.“Live chat response time under five minutes? That is rare. That is why I stick with FxCash,” shared Linda Zhao, a swing trader based in Singapore.

User reviews across Reddit and Trustpilot reinforce these claims (for example, and forum threads discussing rebates). Awards—such as the Global Forex Expo Best Cashback Platform 2025—further establish trust.

Real authority is not claimed. It is earned—through clarity, speed, and trader respect. If you want an apples-to-apples comparison while you read, keep an eye on our own curated pages for and detailed to benchmark providers.

Top Cashback Providers in 2025

Choosing the right Forex cashback platform can be tricky. Here’s a breakdown of top providers in 2025 based on features real traders care about — from ease of use to tech tools.

1. Best Rebate Sites for Beginners

If you're just getting started with Forex cashback programs, you’ll want platforms that feel like a walk in the park — not a maze. Beginner-friendly rebate platforms prioritize a clean user interface, live customer support, and educational resources.

Low minimum deposits (as little as $10)

Interactive tutorials for first-timers

Real human support (not just bots)

Hot picks? and are known for their newbie-friendly vibes. For newcomers, our primer is a solid place to start.

2. Platforms with Fastest Payout Times

Payout speed matters — nobody wants to wait weeks to withdraw earnings. The best cashback sites offer lightning-fast processing times and flexible payment options like e-wallets and instant bank transfers.

| Platform | Avg. Payout Time (hrs) | Payment Options |

|---|---|---|

| 12 | Skrill, Neteller, Wire | |

| Premium Rebate | 24 | PayPal, Crypto, Bank |

| 8 | Instant e-wallet |

FxCash and Premium Rebate publicly describe fast processing and flexible withdrawals (; ).If you prefer direct broker rebates instead of third-party platforms, some brokers (e.g., ) publish tiered programs for high-volume traders.

3. Brokers Supported by Top Providers

Not all cashback providers support every Forex broker. Picking the right one depends on broker compatibility, regulation status, and your preferred trading account types.

Pepperstone, IC Markets, and FOREX.com are widely supported or commonly paired with rebate platforms—see , , and .

Regulated brokers = safer rebates (IC Markets outlines its regulation status and risk warnings: ).

Look for cashback providers that let you connect ECN, Standard, and even demo accounts—provider broker pages (e.g., PaybackFX broker profiles) usually list account types, minimum deposits, and payout logistics.

Tip: Always double-check if your broker is before signing up!

4. Cashback Sites with Automation Tools

Want to keep things hands-free? Modern rebate sites now include automation tools, perfect for traders using bots, trading robots, or complex setups with API integration.

• Full automation for tracking and rebate collection • Backtesting support for performance insights • Advanced dashboards for algorithmic traders

"As automation continues to transform the trading space, cashback platforms must evolve with it," says Jonas Wright, fintech analyst at AutoFX Labs. If you value tech extras, check out the PAYBACKFX mobile app and real-time tracking () and dashboards that update regularly on platforms like .

Rebate Rates Comparison

Cashback rates can make or break your trading strategy. This cluster compares rebate types and reveals where to find the juiciest Forex deals in 2025.

1. Highest Forex Cashback Rates 2025

Looking for the highest cashback programs in the Forex market? Here’s where the real rebate magic happens in 2025:

Premium-Rebate – up to 90% cashback on selected brokers ().

FxCash – typically offers high returns across major platforms and advertises up to 95% of spread on some setups ().

PaybackFX – consistent competitive rates, with detailed broker pages and calculators ().

| Program | Avg. Cashback Rate | Broker Count |

|---|---|---|

| Premium-Rebate | 90.0% | 60+ |

| FxCash | 85.5% | 50+ |

| PaybackFX | 78.2% | 100+ |

“High rebates can mean higher returns, but always factor in broker quality too,” says Daniel R., FX industry analyst at TradeBetter Labs. If you want to compare against our in-house offers, check our and run numbers with the .

2. Spread-Based vs. Commission Rebates

Alright, let’s break this down in plain English — spread-based rebates and commission-based rebates are both cashback, but they hit your wallet differently.

Spread-Based Rebates: You get a rebate per pip or spread unit. Ideal for high-frequency, lower-spread trading.

Commission Rebates: These kick back a portion of broker commissions — better suited for ECN and pro account users.

Commission rebates usually give more bang for your buck if you’re trading big lots. To see how this plays out by broker/account type in the wild, browse individual provider pages (for example, or ).

Comparison Summary:

Spread-Based = predictable, lower rebates.

Commission = higher potential but more volatile.

In the , knowing this difference is your first real win. For a refresher on how rebates reduce effective costs, see our overview of and .

Are Forex Cashback Services Legit and Safe?

Forex cashback sounds great — but is it legit? Let’s dive into what makes these services trustworthy and how you can spot the real ones from the scams.

When exploring Forex cashback platforms, safety is more than a nice-to-have — it’s a non-negotiable. Here’s how to sniff out secure, reliable programs and avoid getting burned.

Regulation and Transparency

Look for platforms that clearly list regulatory affiliations with licensed brokers. If they’re shady about this or hide terms and conditions, run — don’t walk. Cross-check with your broker’s regulation page (e.g., ) and verify that rebate platforms state their relationship is purely commission-sharing that does not change trading conditions (see ).

Reputation & User Reviews

Trusted services have consistently positive user reviews across trading forums like ForexFactory or third-party review sites such as and Myfxbook provider pages.A sea of complaints about missing payments or shady fees? ? Red flag. You can also skim community chatter on rebate threads (e.g., ).

Data Protection & Payment Security

Respectable cashback providers implement SSL encryption, protect your account data, and support secure payment methods like PayPal, Skrill, or bank wires—see payout method examples in provider docs such as FxCash’s scheme and PaybackFX broker pages mentioning withdrawal options (; ).

"Rebate platforms are only as good as the security they offer. A flashy website is useless if they don’t safeguard user data." — Jason M., FX Compliance Analyst

Scam Signals

If it looks too good to be true, it probably is. Be cautious of:

Promises of 100% cashback

No clear terms & conditions

Anonymous broker affiliations

No visible contact or support

Trust Score Factors Comparison

| Factor | Safe Provider | Risky Provider |

|---|---|---|

| Regulation | FCA / ASIC Licensed | No mention |

| Payment Methods | PayPal, Wire, Skrill | Crypto only |

| Data Protection | SSL, 2FA | None |

Safety starts with research. Stick with platforms that are transparent, have a strong reputation, and play by the rules. Avoid the sketchy ones and you’re golden. As you evaluate options, you can also consult our for common questions and support routes.

Conclusion

Getting paid back for trades you were already going to make? That’s like finding money in an old coat pocket. Forex cashback programs aren’t just smart—they’re a no-brainer for anyone serious about squeezing more out of every pip. If you want to see how much you could earn with your current strategy, plug your volumes into our and plan around key events with the .

Most traders lean toward names like or —they’re fast, easy, and work with the big-name brokers. As Warren Buffett says, “Do not save what is left after spending, but spend what is left after saving.” Ready to move from research to results? Explore our current , compare , and, if you also use trade ideas, check our curated

FAQ

A Forex rebate program is a way for traders to get back a portion of the trading fees (spread or commission) they pay to their broker. Essentially, it works like cashback. You trade as usual, and your rebate provider returns part of the cost to you — either daily, weekly, or monthly. It’s a smart way to reduce trading expenses without changing your trading strategy.

Yes — if you’re actively trading, even small rebates can add up significantly over time. Think of it as getting a discount every time you place a trade. For frequent traders, rebates can improve overall profitability and lower break-even points.

Rebate rate: Higher isn’t always better, but it’s a good starting point.

Broker coverage: Make sure your preferred broker is supported.

Payout speed: Weekly or monthly payments? Some do instant.

Support and transparency: A responsive team goes a long way.

Platform features: Automation, dashboards, reporting tools.

Not always. Many rebate sites partner only with certain brokers. You’ll usually need to sign up (or re-sign up) with the broker using a unique referral or tracking link provided by the cashback platform. If you're already registered with a broker, switching to a cashback program might not be possible unless you open a new account.

Great question! These are closely related. When a rebate platform refers you to a broker, they earn what’s called IB commission (Introducing Broker commission). Instead of keeping it all, the platform shares a percentage of that commission back with you as a rebate. So the rebate is simply your cut of what the platform earns from the broker.

This depends on your country and your tax situation. In many cases, rebates are considered trading-related income and may need to be declared — especially for professional traders or those withdrawing large amounts. You should consult with a local tax professional to be sure.

Each has varying payout structures, so it’s worth comparing them based on your trading volume and preferences.

IC Markets

Pepperstone

RoboForex

FXTM

MultiBank Group

Sometimes, yes — but often not both at the same time. Some brokers limit the use of cashback alongside bonus programs to prevent double benefits. It’s best to check the fine print, or ask customer support directly if you can stack them.

Some platforms also offer auto-withdrawal features or minimum payout thresholds.

Bank transfer

PayPal

Skrill or Neteller

Crypto (e.g., USDT, BTC)

Internal broker transfer